COVID-19: The Self-Employment Income Support Scheme

Date: 15/04/2020 | COVID-19, Business & Professional Services, Corporate, Employment & HR

In addition to the Coronavirus Job Retention Scheme, for employees and workers, the UK Government has also provided details of a “Self-employment Income Support Scheme” (“SISS”). This article provides an overview of SISS, including its eligibility, the amount an eligible person is entitled to and the application process.

Overview

The SISS will allow an eligible person to claim a taxable grant up to a capped amount upon application by invitation.

Eligible Person

To apply for the scheme, an individual must, firstly, be either:

- A self-employed individual; or

- Member of a partnership

Secondly, an individual in such a position must have:

- Submitted their Income Tax Self-Assessment tax return for the 2018-19 tax year;

- Traded in the 2019-2020 tax year;

- Be trading when the application is made for the SISS or be in a position that they would otherwise be trading but for coronavirus;

- Intend to continue to trade in the tax year 2020-2021; and

- Have lost trading/partnership trading profits due to coronavirus.

It is important to note that the requirement for an individual to have submitted a Self-Assessment tax return for the 2018-19 tax year means that newly self-employed individuals (from April 2019 onwards) will not be eligible for the scheme.

Thirdly, an individual’s self-employed trading profits must be less than £50,000 and more than half of an individual’s income must be from self-employment. Establishing these requirements can be shown either from the figures for the 2018/19 tax year alone or by an average across either of the following tax years together: (1) 2016/17, 17/18 and 18/19; or (2), if an individual only started trading in the 17/18 tax year, 2017/18 and 18/19.

The guidance states that HMRC will use data on 2018/19 Income Tax Self-Assessment returns to identify those eligible. However, an application (by invitation only) still requires to be made, as detailed below. It is also not clear how the 2018/19 Income Tax Self-assessment return will show the eligibility through the “average” trading profits and self-employed income route over the financial years 2016/17-2018/19. It is to be assumed that HMRC will also assess eligibility on the basis of an “average” over tax years, given that is a ground for eligibility.

The SISS scheme does not apply to individuals who, whilst essentially self-employed, operate through a corporate structure. However, the Coronavirus Job Retention Scheme (“CJRS”) does make provision for such individuals to fall within its scope.

Capped Amount

If an individual is an eligible person, then the amount that will be provided under the SISS is 80% of the average profits from the taxable years 2016/17, 17/18 and 18/19 (if all are applicable to the individual) up to a maximum of £2,500 per month for 3 months. If the individual started trading during this period, HMRC will only use the years for which an Income Tax Self-Assessment return was filed.

The payment is a taxable grant that will be paid directly into the individual’s bank account in one instalment.

Applying for the Scheme

The application process is not live yet. The guidance states that HMRC will contact individuals who are eligible for the scheme and invite those individuals (as eligible persons) to apply online through the gov.uk website.

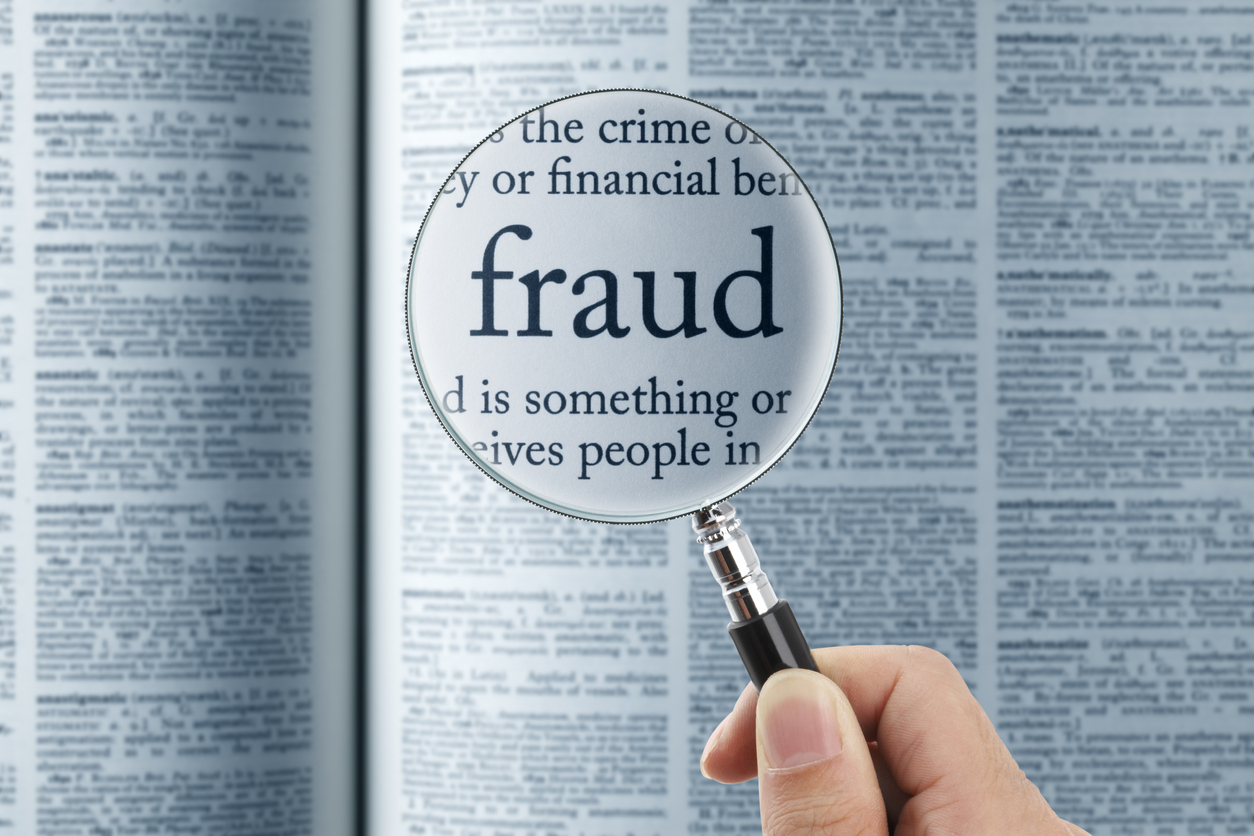

The means of contact by which HMRC will initially contact eligible persons is not clear. The timing of the contact is also not clear. Care should clearly be taken in considering whether emails, texts or phone calls are genuine or scams and you should ensure the people you are communicating with are who they purport to be to avoid handing over sensitive personal information.

Once an application has been made, HMRC will contact the individual to inform them of the amount that they will receive and the payment details.

The above overview is based on guidance published by the UK Government on 26 March 2020 which you can find here.