The Rental Income Guarantee Scheme

Date: 19/01/2018 | Real Estate, Residential Development

The first of its kind in the UK, the Rental Income Guarantee Scheme (RIGS) was launched by the Scottish Government on 12 October 2017 as part of its wider efforts to boost the Build to Rent sector.

Put simply, RIGS involves the Government sharing a percentage of the landlord’s rental income risk. It is managed by Scottish Futures Trust Limited (SFT), and guarantees a percentage of the agreed annual rental income forecast (ARIF) where there is a shortfall between the ARIF and the actual annual core rental income during the first three to five years.

How does it work?

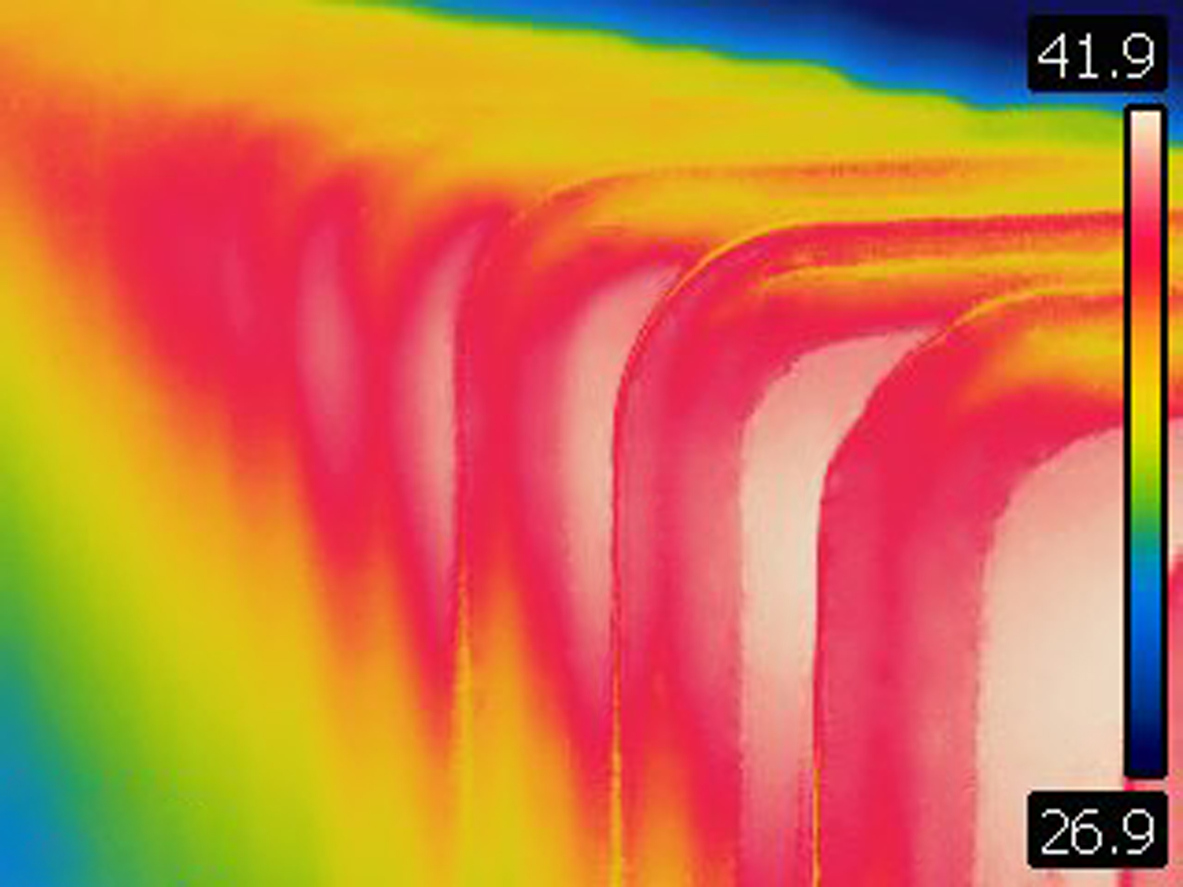

The guaranteed amount depends on the percentage of shortfall, as set out below:

| Shortfall percentage | Guaranteed amount |

| 95% – less than 100% | 0% |

| 75% – less than 95% | 50% of the difference between:

|

| Less than 75% | 10% of the annual ARIF |

To be eligible for the Scheme, the following mandatory criteria must be met:-

- the units must be in Scotland

- the core rental income must be generated from at least 30 eligible units;

- the units must be owned by an appropriately regulated entity or partnership which can demonstrate good and marketable title to the units at the commencement date;

- the management or maintenance provider of the units must be appropriately registered and comply with any applicable letting code of practice prior to the commencement date;

- the site of the units must benefit from at least outline planning permission; and

- the submitted application templates must demonstrate the overall long-term financial viability of the units (this will be assessed by the SFT)

In addition to this, the units must be complete and available for letting within two years from the date of signing the Guarantee.

Although no application fee is payable, the Guarantee is subject to an annual 1.22% fee. An initial 25% deposit of the first year’s fee is also required when entering into the Agreement.

Guidance on the full application process is provided on the dedicated RIGS website (along with a helpful application timetable chart).

The beneficiary can terminate the Guarantee at a month’s notice or transfer it as part of a sale, subject to certain conditions being met. The rights, title and interest in the Guarantee can also be assigned to a funder.

Although the SFT has yet to receive a formal application, RIGS has generally been viewed favourably by potential investors as it provides a level of security during the initial stages of the process – often the riskiest. It will be interesting to see whether this leads to increased investment in the property sector.

If you require any further information please contact our Commercial Property team.