Rethink Needed on Red Diesel Policy

Date: 11/06/2021 | Environmental, Regulatory Law

While there’s a strong environmental basis for the UK Government’s plan to limit the use of red diesel, there are growing concerns about the potentially damaging economic impact of this proposal.

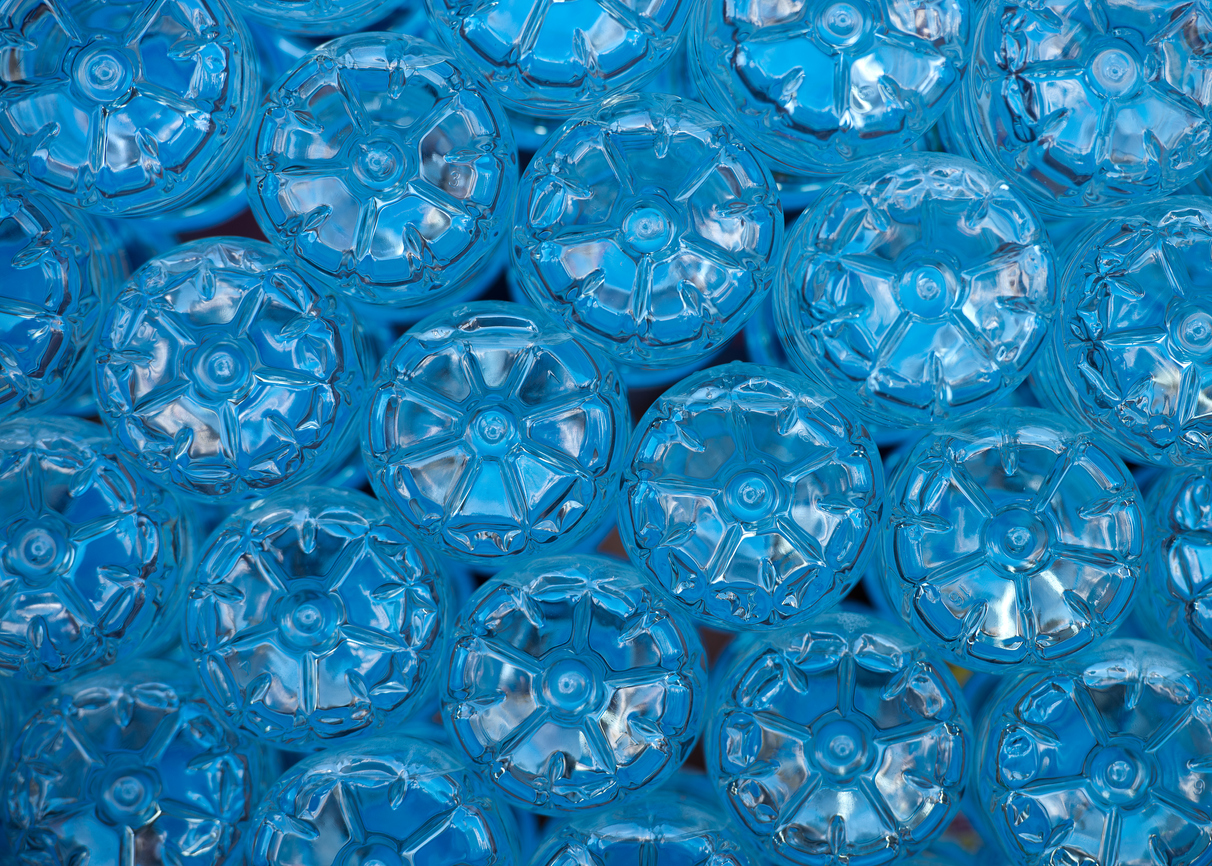

Red diesel, taxed at a significantly lower rate than standard diesel, is intended for use in off-road vehicles, generators, machinery and plant equipment. Accounting for around 15% of diesel consumption, the red-dyed variant is used across many industry sectors including waste and recycling, agriculture and construction.

Under the current plans, most sectors except agriculture (including horticulture, forestry, and fish farming), rail and non-commercial heating will no longer be allowed to use red diesel from 1 April 2022.

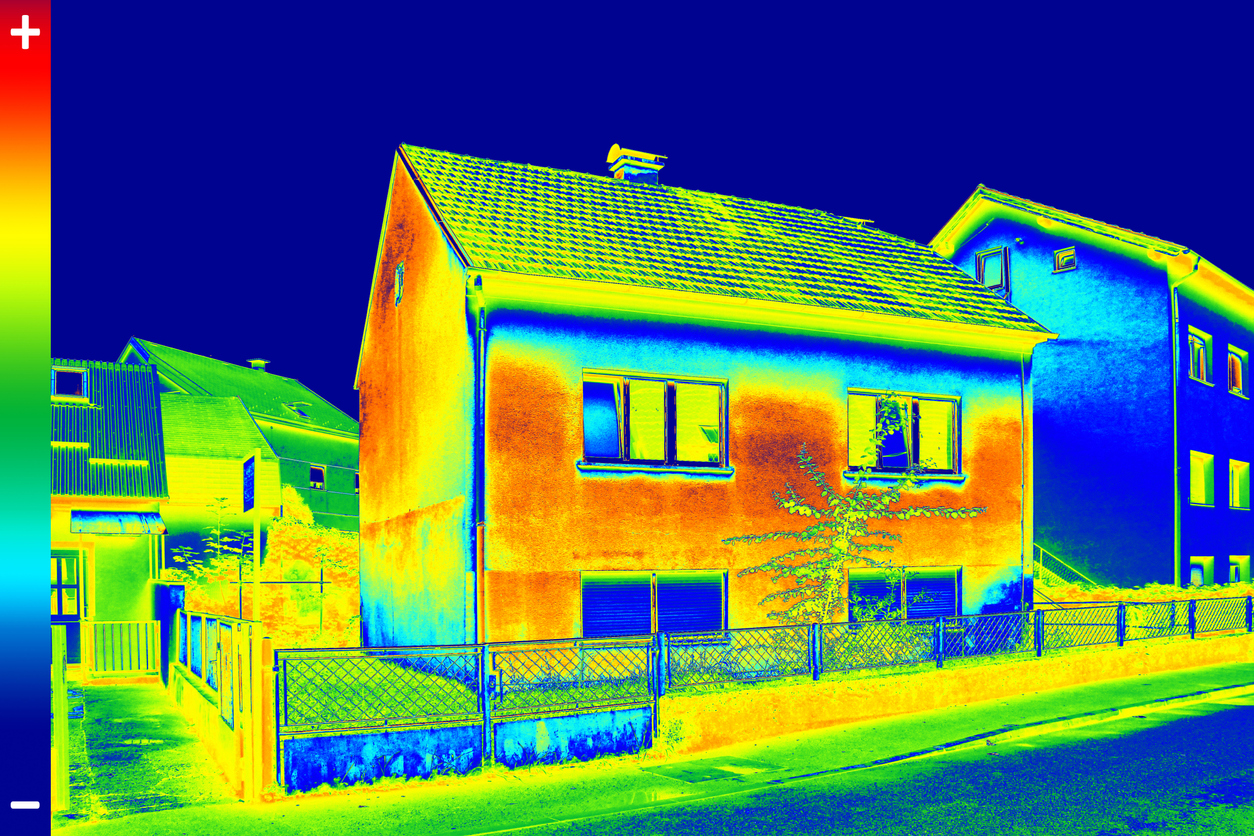

The intention behind this policy is to be welcomed as it’s focused on helping meet climate change and air quality targets with the UK seeking to bring greenhouse gas emissions to net zero by 2050. With red diesel believed to be responsible for the production of nearly 14m tonnes of carbon dioxide a year, the Government argues that taxing pollution and dangerous greenhouse gas emissions at the same rate, whether the fuel is burnt on or off road, is fairer than allowing distortions to continue.

Using the tax system to incentivise users of polluting fuels to improve energy efficiency of vehicles and machinery can be an effective approach, however, with the UK economy emerging from the pandemic and its worst crisis in living memory, there are compelling reasons for a rethink on the red diesel policy.

The policy was announced by Chancellor Rishi Sunak in his first Budget, delivered on 11 March 2020, prior to the UK Government fully getting to grips with the implications of Covid-19. Less than two weeks later the nation was in lockdown with much of the economy, including most construction projects, coming to an abrupt halt.

Coronavirus has since had a significant impact on the construction industry. The Office for National Statistics (ONS) figures showed that in the three months to May 2020, UK construction output fell by 40%. More recent ONS figures suggest an upturn, but there is still fragility in the market and recovery in the commercial sector has been slower due to store closures, low rent collection in retail and leisure, and the shift to home working.

Given the extent of the challenges facing the construction sector, it’s not surprising to see a number of industry bodies lobbying the Government on the issue of red diesel. These include the Construction Plant-Hire Association; Hire Association Europe; International Powered Access Federation; Scottish Plant Owners Association; National Federation of Demolition Contractors; and the Scottish Building Federation which have written to Mr Sunak asking him to extend the deadline for the removal of the red diesel entitlement to 2023 to allow more time for economic recovery.

These groups all argue that alternatives to diesel power for most types of heavy machinery are not viable yet and the increased cost in fuel would reduce their ability to invest in machinery which is less polluting.

This lack of viable alternatives means that many operators will be facing a higher tax burden as they’ll have to rely on standard white diesel fuel which is taxed at nearly 58p per litre compared to the 11.14p per litre charged on red diesel. The removal of the red diesel subsidy will therefore hike up costs across the construction sector at the very time when many businesses are trying to get back on their feet from the impact of the pandemic as well as other developments including Brexit.

Rising construction costs are likely to impact on the wider economy as these tax increases would need to be passed down the chain.

According to the Civil Engineering Contractors Association, losing the red diesel rebate could cost the UK construction industry between £280m to £490m a year. Those companies that are locked into long term contracts with fixed pricing will see already tight profit margins further squeezed with greater pressure inflicted on their supply chains. This outcome will limit the scope for investment in new skills and cleaner, greener technology and could ultimately undermine progress.

There’s no question that polluting greenhouse gases need to be tackled with the planet facing climate change emergency but it’s important to strike a balance.

A staged approach with reasonable lead-in time that would ensure alternative technology is available and mitigate huge cost increases would enable many construction operators to transition more comfortably towards greener solutions and remain in business.

The ending of red diesel usage should not simply become an unavoidable cost to already struggling businesses.

Given the UK Government is the construction sector’s largest consumer and will likely end up paying much of the cost, some flexibility on the red diesel policy seems inherently sensible.

This article was first published in Project Scotland on 11 June 2021.