Talking Dirty – An Environmental Blog: Does Landfill Tax Go Far Enough?

Date: 11/04/2016 | Environmental, Blogs

Landfill tax was introduced to the UK in 1996 and was the first environmental tax designed to make other forms of waste treatment more financially attractive and cut the volume of material – those capable of being reused or recycled – ending up in landfill sites.

Currently, landfill tax is paid to HM Revenue & Customs in relation to sites located in England, Wales and Northern Ireland. The tax will be devolved to Wales from 1 April 2018 and replaced with a new Landfill Disposals Tax. Proposals are in the final stages of passing through the Welsh National Assembly as part of the Tax Collection and Management (Wales) Bill 2015.

Landfill sites in Scotland were deregistered from UK landfill tax on 31 March 2015 and operators are now liable to pay landfill tax to Revenue Scotland.

Following last month’s Budget announcements, there will be further changes made to both landfill tax regimes currently operating in the UK.

The standard and lower rates of UK landfill tax started to increase in line with the retail prices index from 1 April, and will do so again in 2017 and 2018, with future rates shown in the table. The Scottish Landfill Tax (Standard rate and Lower rate) Order 2016 confirms that the position will be the same in Scotland.

While some would argue that these inflationary increases are appropriate given the more significant increases made in previous years, the contrary view is that these increases do not present enough of an incentive to all businesses to make the move away from landfill completely.

The value of the Landfill Communities Fund (LCF), a tax credit scheme that enables operators of landfill sites to contribute funding to local good environmental causes, is to be lowered to £39.3m for 2016-17. From 31 March 2018, the fund will cease to be applicable in Wales.

To date, the LCF has seen operators run successful schemes which use 90% of the landfill tax credits to fund their chosen projects, with the remaining 10% being funded by a third party such as a local charity.

The Budget announcement confirming that the Government will not proceed with its initial plan to remove this option for third parties to make up the 10% balance has been welcomed by the waste industry. The general consensus was that, had this change been introduced, the resulting additional costs to landfill operators would have led to them being unable to contribute to the scheme and prevent a number of community projects from going ahead.

But operators will be put under more pressure to directly support LCF-backed projects by making greater contributions from this month onwards. In addition, the maximum contributions by landfill operators (the credit that they will be able to claim against their annual tax liability) will be capped at 4.2%, a reduction from the existing 5.7% cap.

Landfill Tax Rates:

| Waste to Landfill | Current Rate | From 1st April 2016 | From 1st April 2017 | From 1st April 2018 |

| Standard Rate (per tonne) |

£82.60 | £84.40 | £86.10 | £88.95 |

| Lower Rate (per tonne) |

£2.60 | £2.65 | £2.70 | £2.80 |

The contribution cap relating to the equivalent fund in Scotland, the Scottish Landfill Communities Fund, is set to remain at 5.6%.

The introduction and administration of the Scottish landfill tax has not been an entirely smooth process. There were issues with late registration and payment by operators, in part due to failures in the dissemination of information and guidance at the outset.

There also remains a lack of understanding, despite continued engagement between Revenue Scotland and industry representatives, as to the classification of some materials and consequently the appropriate rate of tax chargeable for those – most controversially in relation to contaminated soils.

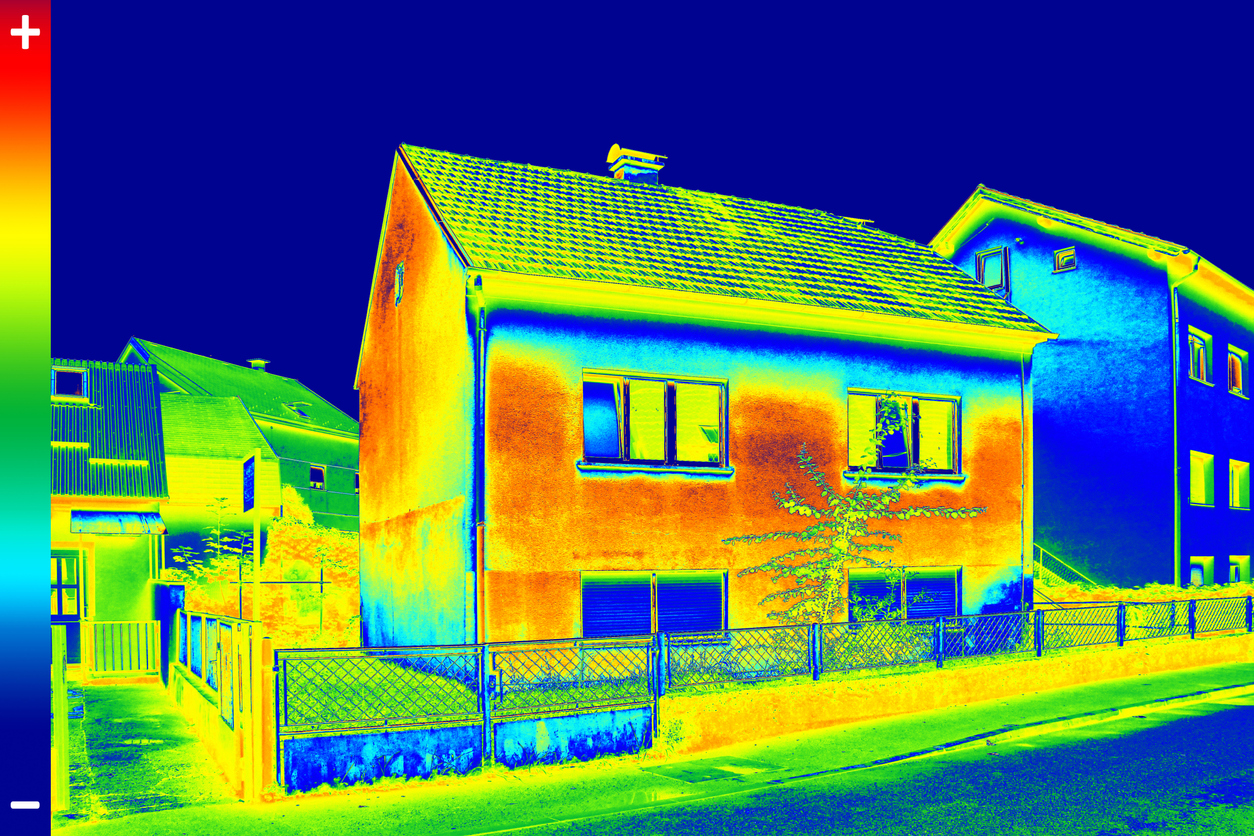

Those in the remediation sector staunchly argue that there are hundreds of tonnes of soil being deposited unnecessarily in landfill sites because the lower rate of tax is being applied to loads of contaminated soil which could be better used, following treatment, in a variety of ways.

With the focus on the circular economy agenda, one has to ask whether they have a point. There are complicated arguments on both sides of this issue which perhaps merit a more in-depth discussion. This article first appeared in the 8th April 2016 edition of Materials Recycling World.

If you would like advice on anything contained in this article, contact me on 0131 625 9191 or via email, twitter or linked-in.