What You Need to Know About the Plastic Packaging Tax

Date: 11/05/2022 | Environmental

Last year we wrote about the introduction of the plastic packaging tax: Is Your Business Prepared for the Plastic Tax?

Since then, the regulations fleshing out the details of the tax have been finalised and the tax came into force on 1st April 2022.

What is the aim of the plastic packaging tax?

The aim is to provide an economic incentive for business to use recycled material in the production of plastic packaging. That should create a greater demand for this material and in turn stimulate increased collection and recycling of plastic waste, diverting it from landfill or incineration.

The tax is charged at £200 per tonne on finished plastic packaging components containing less than 30% recycled plastic content. Businesses who import or manufacture less than 10 tonnes of plastic packaging in a 12-month period are exempt.

Who will the tax affect?

Manufacturers and importers of finished plastic packaging components are affected directly as they are liable to pay the tax. However, the cost is likely to be passed onto customers of manufacturers and importers of plastic packaging and consumers who buy goods in plastic packaging. It is important to note that others in the supply chain, such as those purchasing plastic packaging components from another business, can be held jointly and severally (or secondarily) liable for any plastic packaging tax which has not been paid by the primary responsible business if they have not adequately carried out due diligence and kept records.

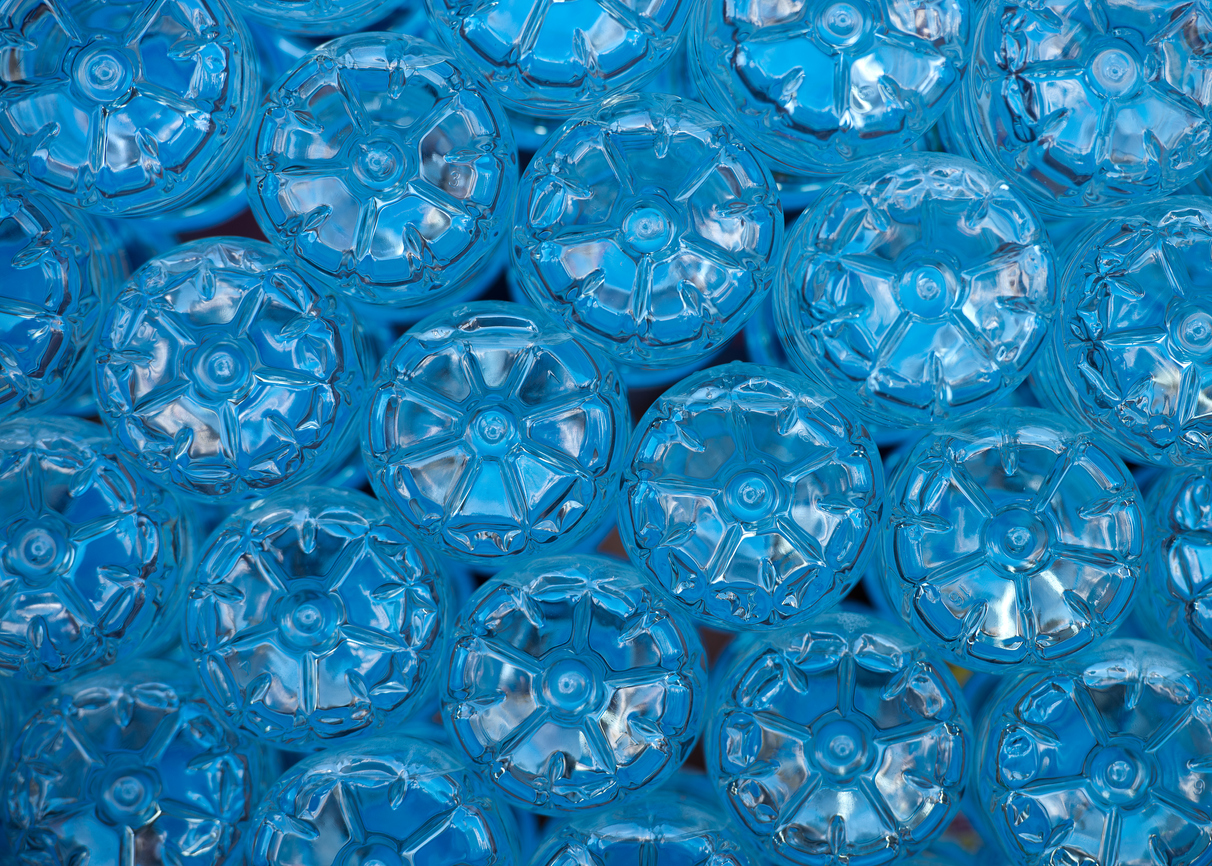

What is considered plastic packaging?

Plastic means a polymer material to which additives or substances may have been added and includes polymers which are biodegradable, compostable and oxo degradable. The tax applies to plastic packaging components which are predominantly plastic by weight. If a plastic packaging component is made of multiple materials but it contains more plastic than any other material, it will be considered predominantly plastic by weight. HMRC gives an example of a 10g carton made up of 4g plastic, 3g aluminium and 3g cardboard. In this case all 10g will be considered plastic as this is the heaviest material by weight.

There are two types of plastic packaging subject to the tax, namely packaging designed to be suitable for:

- use in the supply chain or

- single use by the consumer.

HMRC list several examples of in scope plastic packaging such as salad bags, crisp packets and clothes hangers designed to be used in the supply chain. Examples of out of scope products given include bags for life, reusable coffee cups and toys and storage boxes.

In addition four particular categories of plastic packaging are out of scope for the tax. These are:

- plastic packaging where the primary function is for storage, such as glasses cases and board game cases;

- plastic packaging which is an integral part of the goods, such as ink cartridges and inhalers;

- plastic packaging to be reused primarily for presentation, such as shop fittings; and

- plastic packaging permanently set aside for a non-packaging use, such as plastic film used to coat whiteboards.

Plastic packaging component

If your packaging is made up of several packaging components, you must account for plastic packaging tax on each component. Individual packaging components are generally manufactured separately before being assembled. HMRC give several examples such as bottles, caps and labels being manufactured separately before being assembled to make packaging for drinks and trays, boxes and plastic windows being manufactured separately before being assembled to make packaging for foods.

Finished product

Plastic packaging tax is chargeable when the plastic packaging component is finished if this takes place in the UK or when finished plastic packaging is imported. If you import plastic packaging filled with goods, this will be treated as finished and you will be liable for the tax on the packaging. If you manufacture plastic packaging, you need to consider when that packaging meets the definition of ‘finished’. A component is finished when it undergoes its last substantial modification. Where the last substantial modification happens as part of the packing or filling process, the component is finished after it has undergone the last substantial modification prior to that. The business which undertakes the last substantial modification is liable for the tax. HMRC guidance explains what counts as a substantial modification.

Exemptions

Four exemptions apply as follows:

- Plastic packaging manufactured or imported for use in the immediate packaging of a medicinal product;

- Transport packaging used on imported goods;

- Packaging used as aircraft, ship and rail stores;

- Components permanently designated or set aside for use other than a packaging use.

In addition, where packaging is intended for export, payment can be deferred up to 12 months as long as certain requirements are met. If the packaging is then exported within the 12-month period, the liability for the tax is annulled.

Businesses can also claim a credit if they paid tax for a finished plastic packaging component they manufactured or imported which is then exported or converted into a different finished plastic packaging component. The credit must be claimed within two years of the component being manufactured, imported or converted into different finished packaging. Records evidencing that the credit is due will be required.

Registration and record keeping

Businesses must register for plastic packaging tax if

- At any time after 1st April, they expect to manufacture or import at least 10 tonnes of plastic packaging in the following 30 days. In this case registration is required within 30 days of the first day this condition is met; or

- they manufactured or imported at least 10 tonnes or more of plastic packaging in a 12-month period ending on the last day of a calendar month. In this scenario the business becomes liable for the tax from the first day of the next month and must register by the first day of the subsequent month. In the first year of the tax, a business only needs to register for the tax when the amount of plastic packaging exceeds 10 tonnes in a 12-month period from 1st April 2022. Therefore, anything before this date need not be counted.

If either of these conditions is satisfied, the business must register even if their packaging is not chargeable to the tax.

Plastic packaging used for human medicinal products and plastic packaging permanently set aside for non-packaging use, must be included when working out the total weight of packaging manufactured or imported.

HMRC guidance clearly states that all plastic will be assumed to be made using non-recycled material, unless there is evidence that recycled material has been used. Therefore, accurate record keeping is essential to support the information you submit in your returns. HMRC specify that you must keep these records for 6 years from the end of the accounting period they relate to. Records must be kept by reference to each product line and show:

- evidence of any exemption from the tax;

- the recycled content if 30% or more of the plastic used in the component is recycled.

More detail on record keeping can be found on HMRC’s website.

Given that other businesses in the supply chain can be held liable if they knew or ought to have known that plastic packaging tax has not been paid, it is vital that they undertake proper due diligence. HMRC do not provide a list of checks and advise that it is up to businesses to decide what is relevant, reasonable and proportionate to their business.

At Davidson Chalmers Stewart we assist organisations in understanding what their responsibilities are, and will be, and help them plan for the changes necessary to ensure business continuity.

If any of these issues resonate with you or you would like to understand more please contact Laura Tainsh at laura.tainsh@dcslegal.com