Corporate Groups – Why Be in One?

Date: 17/04/2024 | Corporate

Clients often ask: what does it mean legally to be in a corporate “group” and why would they want to use a group structure?

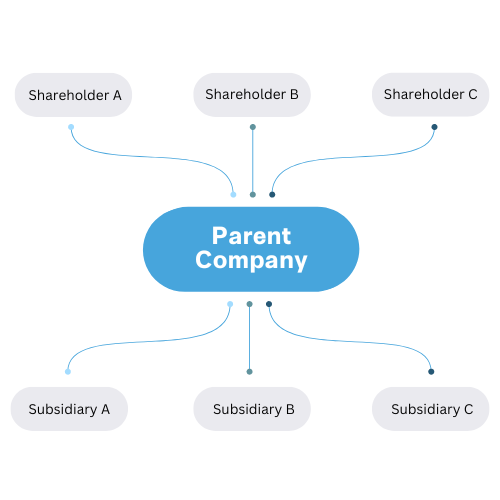

Simply put, a corporate group exists when one company owns one or more other companies. The company at the top is called the parent company and those beneath are called subsidiaries. All the group’s businesses are ultimately owned by the same shareholders that own the parent company even though they are separate companies.

Clients decide to put group structures in place for a variety of different reasons, but the three key drivers are: risk management, exit strategy and tax benefits.

Risk Management

A group structure helps manage risk in all sorts of ways. If you wanted to launch a new product or move into a new market, for example, doing this through a separate company can protect the existing business from taking on liabilities in relation to the new venture. It can also allow development of separate brands or expansion into different geographic locations – all with less risk of damage to the core business.

Protecting key assets like land and buildings or intellectual property can be achieved by putting them in a separate group company and then licensing the right to use these to the rest of the group. That way if the trading business was to become insolvent then those assets are protected.

Using a separate company for certain trading activities can help to manage regulatory issues; all trading that requires oversight from a regulator can be done through one company with the rest done through another member of the group. This keeps the regulator’s oversight limited to only relevant business streams and can making obtaining regulatory accreditation simpler and quicker.

Exit Strategy

Often people put a group structure in place as part of their exit strategy. If you have a company that has several business streams, putting each division into a separate group company allows these to be more easily sold off as separate businesses and makes them more attractive to the right buyers.

Selling a company with three business streams – for example, a letting agency, a logistics business and nursery – is difficult as those three divisions are attracting different Buyers. Splitting them into a parent company and three subsidiaries allows a quick sale of the logistics business and a sale of the nursery in the medium term and the sale of the letting agents as the final exit. Using a group structure in that scenario offers flexibility on timing and can help to maximise returns.

Tax

Tax benefits are a key advantage of having a group structure. If the same clients own three businesses using separate companies, then they can’t pool tax losses and reliefs – transfers of assets between group companies are not tax neutral and there are no reliefs from corporation tax and stamp duty available. All these benefits flow from having a group structure in place.

So, what are the disadvantages to operating a group structure? There are a few issues to consider.

- Admin: the more companies you operate the more forms there are to file, you need to prepare more sets of accounts and you may need to consolidate them, you have to file additional tax returns etc.

- Complexity: having multiple companies can make governance issues more complex but it can also allow more flexibility as to who is on the board of each company allowing key employees to be on the board of the relevant company.

- Separate Income Streams: it may be worth thinking about separating income streams by having certain assets held outside the trading group. For example, if the property a company occupies is owned by a non-group company the owner of that company can receive an ongoing income from the property even if the trading company is sold. Specialist tax advice is needed before pursuing such a course of action.

Whilst not for everyone if you have multiple business streams or work in different geographic areas, a group structure can be very useful and well worth considering.

If you need advice on putting a group structure in place then speak to our knowledgeable Corporate team.