Section 479A Audit Exemption – Who, What, When, Where and Why?

Date: 19/06/2024 | Corporate

Audits are expensive both in terms of time and money so qualifying for an exemption can be a big plus. There are several audit exemptions available depending on a variety of factors including whether a company is part of a small group or, in the case of a subsidiary company, whether it is trading or dormant.

The s.479 exemption has been in play since October 2012 and when it was first introduced the Government believed that around 83,000 subsidiary companies would benefit from it and it could save between £100m-£390m annually in respect of auditors fees. Yet, this exemption has not been utilised to its fullest extent. There are a number of reasons for this. Firstly, many companies do not know about it and those that do, do not understand how to apply due to the unclear and often contradictory guidance available. Secondly, a group’s funding position may also impact on the ability to apply. Many funders require entire groups to be audited. However, given the cost, if your group has a number of subsidiaries some of which are dormant or do not hit the audit threshold, it might be worth speaking to your funder to get consent to apply. Thirdly there are ongoing filing requirements and liability issues that may deter companies from applying.

Who is eligible?

Only a trading subsidiary whose parent undertaking is established under UK law is eligible for this exemption. This is a key change since Brexit. Previously any company with a “parent undertaking being established under the law of an EEA state” qualified but now UK trading subsidiaries with overseas parents will no longer be eligible.

How do you apply?

In order to satisfy the conditions required to apply, a number of documents need to be completed, signed and filed at Companies House.

Firstly, all members of the subsidiary company must agree to the exemption by signing a members agreement which is filed at Companies House. Although it is likely that the subsidiary will be wholly owned, this is not guaranteed and should always be checked as the consent must be unanimous.

Secondly, the parent must give a statutory guarantee of the subsidiary’s outstanding liabilities. The parent gives this guarantee by completing a form AA06 which is filed at Companies House for the subsidiary. It is worth noting that once an AA06 is filed it cannot be removed or revoked and will remain in force until all the liabilities of the subsidiary companies are settled in full. This means that once the form is filed, the parent is permanently on the hook for the subsidiary’s liabilities. If a group wishes to utilise this audit exemption, it should consider carefully whether the parent being indefinitely liable for the subsidiary’s liability is in the best interest of the parent and the group as a whole.

Thirdly, the subsidiary company must be included in the consolidated accounts drawn up by the parent undertaking and the parent undertaking must disclose that the subsidiary company is exempt by virtue of s.479A.

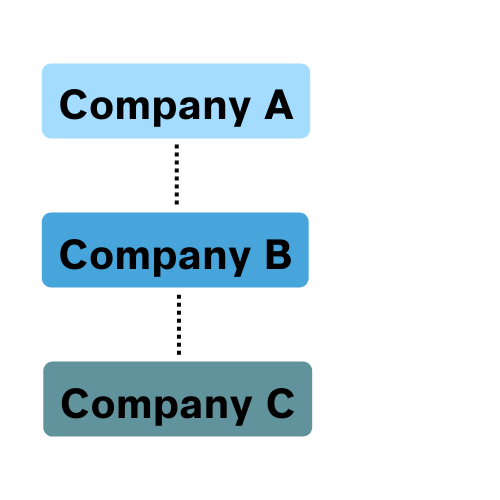

This last point can be problematic. What if the immediate parent company does not produce consolidated accounts? Can the group still apply for a s.479A exemption? For example, take this simple and common group structure:

Say the group wants to utilise the audit exemption for Company C. In an ideal world Company B would produce consolidated accounts. For the audit exemption to be applied Company B would include Company C in its consolidated accounts, a form AA06 and a members agreement would be filed at Companies House for Company C along with a copy of Company’s B accounts. All in all, a relatively straightforward process.

However, say that we change this example so that only Company A produces consolidated accounts – can the exemption still be claimed? The answer is yes. Although Company B is Company C’s parent, Company A is also covered by the definition of ‘Parent’ under section 1162 of the Companies Act and is therefore a parent undertaking of Company C. This means that in this scenario Company A would need to include the details of Company C in its consolidated accounts. A form AA06 and members agreement (signed on behalf of Company B) would need to be submitted to Companies House for Company C along with a copy of Company A’s accounts.

Although the paperwork in the second scenario is not any more complicated than in the first, it is essential to make sure you have correctly identified the parent undertaking for this audit exemption. It is vital to remember that the subsidiary must be included in the consolidated accounts of the parent undertaking and the correct statement made.

If there is no parent who produces consolidated accounts, then the subsidiary will not be eligible for the s.479A exemption. In that case it is likely that the group as a whole may be eligible for a different audit exemption and your accountant will be able to advise on the best course of action.

When can you apply?

Most groups have the same accounting reference date for all their companies. In this case all the accounts and audit exemption paperwork can be filed at the same time. If all the dates do not coincide, then some thought will need to be given about how the preparation of the consolidated accounts overlaps with the subsidiary filing dates as failure to file accounts on time can result in hefty late filing fees.

So, what happens if a subsidiary company has overdue accounts but they want to use the s.479A exemption?

The Companies Act 2006 refers to the date the accounts are filed not the date that the accounts are due to be filed whereas the guidance available online usually refers to the date on or before the date that they file the accounts for that year. It is easy to interpret the latter to mean that if the accounts are overdue that you cannot apply for the exemption. However, the wording of the Companies Act 2006 and the approach taken by Companies House is that the audit exemption can be filed even though the accounts filing date for the subsidiary has passed – although a late filing penalty will still be incurred.

Ongoing Issues

When deciding to apply for this exemption it’s important to be aware of the ongoing obligations it brings.

There is an annual filing requirement in respect to members consent. The Companies Act is clear that shareholder consent must be specific to a financial year so it is vital to ensure that a separate consent for the subsidiary is filed for each year that the exemption is used. Although a single document (i.e. a written resolution) may evidence consent by a parent in relation to multiple subsidiaries, separate copies of the document will need to be filed at Companies House for each subsidiary claiming the exemption. If the members consent is not filed annually than the exemption will not be valid and audited accounts for the subsidiary must be filed.

The irrevocability of the guarantee given also raises some interesting questions.

What happens if the group changes its mind? It may be the case that, due to a new funding structure or a change in group policy, a group decides that all its companies should be audited. Although this exemption does not prevent a company reverting back to filing audited accounts, there is no provision for the parent’s liability under the guarantee to cease (except on the full satisfaction of the subsidiary liabilities). So, in that case, the subsidiary would file audited accounts but the parent would continue to be on the hook for the liabilities.

What happens if the subsidiary is sold? Just as there is no provision to remove the guarantee, there is also no provision to novate it to another party. If the subsidiary is sold, the parent will remain liable under the guarantee. The best case scenario would be to seek an indemnity for the purchaser of the subsidiary but this would not prevent the parent from being liable to the creditors or its former subsidiary. If the group has plans to sell its subsidiary at some point, then this exemption may not be the one to apply for.

Care must be taken to ensure that the subsidiary is included in the parent’s consolidated accounts going forward. If the s.479A statement is mistakenly removed from the parent’s accounts, then corrected accounts will need to be filed and although there is a process for this, it can be costly. Alternatively, audited accounts could be filed for the subsidiary. Again this is costly and as noted earlier does not release the parent guarantee.

If you think you might be eligible for the s.479A exemption, think carefully about the longer term issues. The cost savings may be outweighed by the long term liability issues. Always seek professional advice before you go ahead. If you have any questions contact Vicky Ward or any member of the Corporate Team.